- Midcurve

- Posts

- Is DeFi back?

Is DeFi back?

Vitalik, DYAD, TON, & More

Summer Chop

Week in Review:

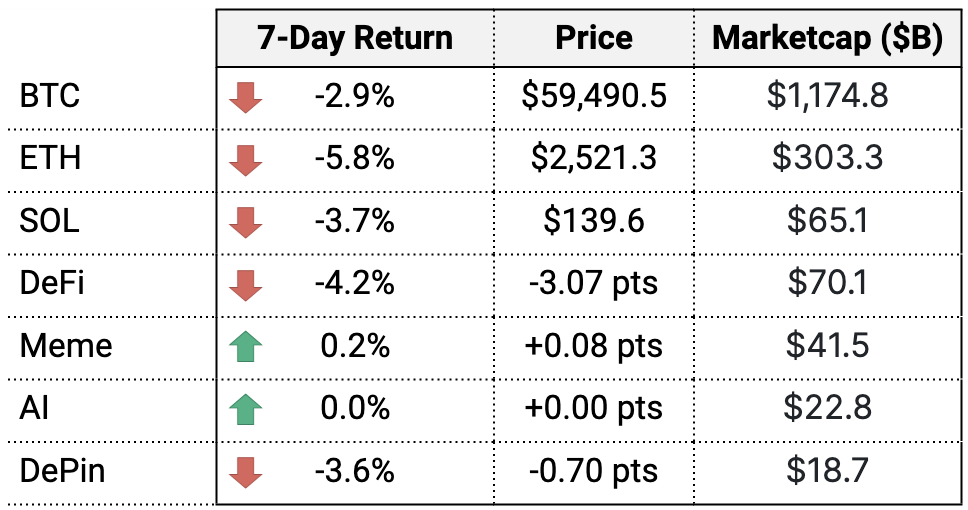

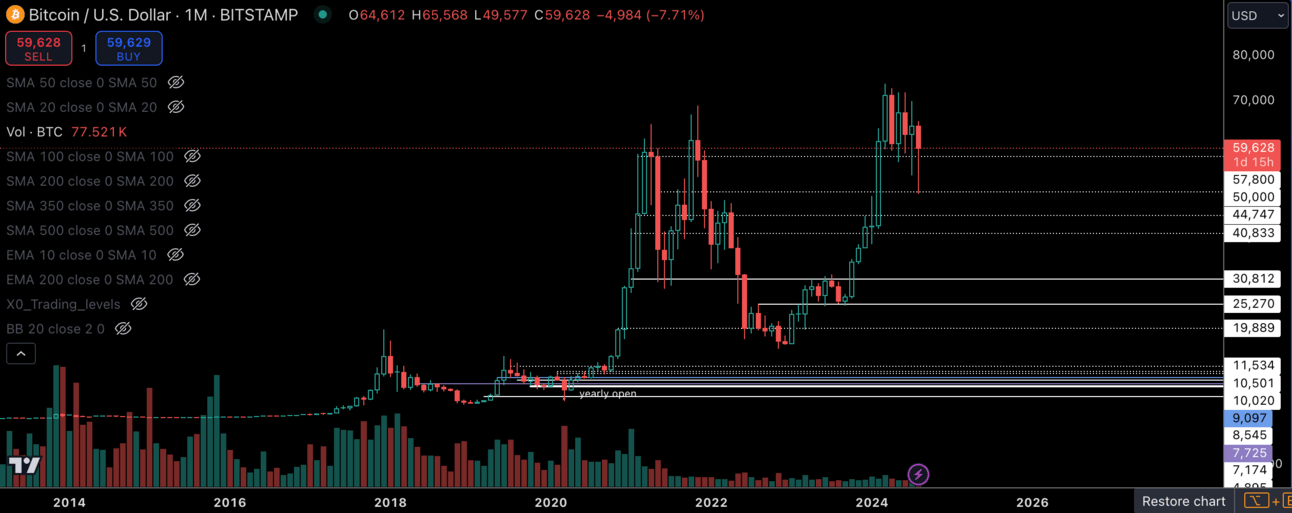

After last week’s rally, prices continue to chop. BTC is down -2.9%, while ETH & SOL are down -5.8% and -3.7%, respectively.

On the back of NVIDIA earnings, the crypto AI sector saw some attention. Notable names include FET +10.2% & Render +4.2%

All eyes are on the monthly charts. While this weak BTC gave back much of last week’s gains, a close at ~$60K would have a bullish pin bar close on the monthly candle.

BTC Monthly

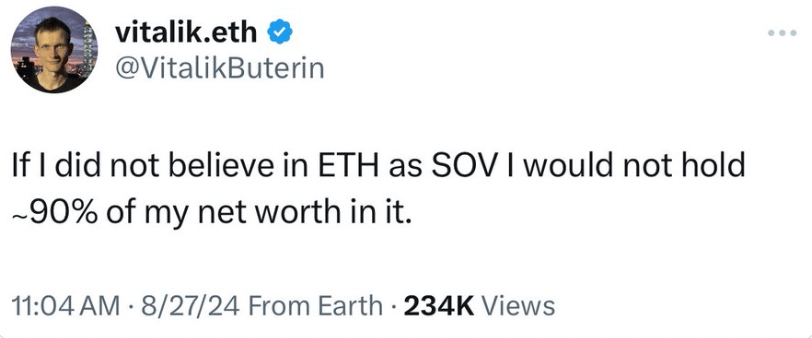

Vitalik Tweets

Vitalik stirred up controversy in his return to Twitter.

One tweet in particular triggered people, which is pasted below. TLDR: Vitalik wants to see sustainable use cases that aren’t reliant on ponzinomics and short-term incentives.

It’s not the most controversial take, but people were upset nonetheless.

My take: This is consistent with what Vitalik has said for years. Paraphrasing, but during DeFi summer, Vitalik mentioned how heavy incentive projects and ponzis were unsustainable. Looking back most projects are down -99%.

The difference?

ETH was the center of attention and had price appreciation alongside an exciting DeFi ecosystem. Today, ETH sentiment is at one of its lowest points ever. The ETH/BTC and SOL/ETH charts have destroyed holders' convictions. So yes, I understand the desire for Vitalik to placate degens, especially now, but that’s not him.

The kinds of applications that I want to see are applications that are (i) useful in a sustainable way, and (ii) don't sacrifice on the principles (permissionlessness, decentralization, etc)

I think DEXes are great, and I use them every week.

I think decentralized stablecoins… x.com/i/web/status/1…

— vitalik.eth (@VitalikButerin)

5:47 AM • Aug 25, 2024

But it wasn’t all bad. If anyone doubts where Vitalik’s loyalty is, this tweet puts that to bed. Unsustainable ponzis might not be exciting to Vitalik, but Ethereum is more than that.

ETH is a permissionless chain. People are free to build whatever they want, regardless of what Vitalik thinks. While his opinion is important, it doesn’t stop anyone from doing whatever experiments they want on Ethereum.

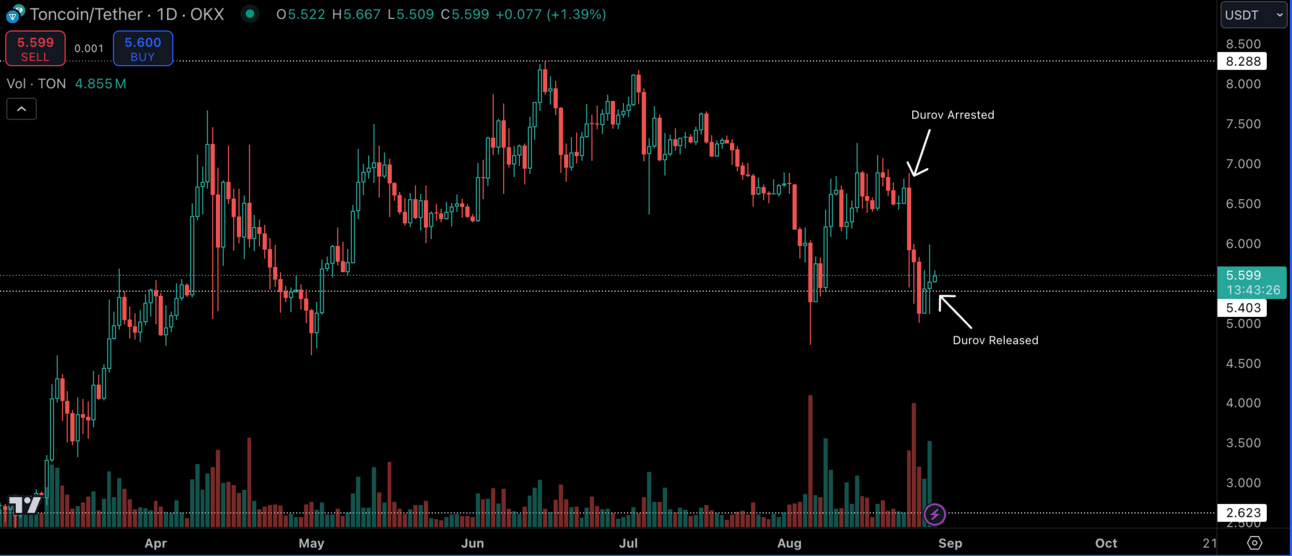

Durov

Pavel Durov, the founder of Telegram, was arrested in France on April 24th for allegations he facilitated illegal activities through his app Telegram. This led to an outcry from social media, with high-profile tech executives like Elon Musk talking about the implications this has for freedom of speech. On April. 28th, Durov was released but forced to post €5 million bail and prohibited from leaving the country. During this period the TON blockchain experienced outages (can’t be unrelated?), but is currently functional.

Before the arrest, TON was building momentum. TON had a TVL of $760M MC and a stablecoin marketcap of $680M. They had a suite of DeFi apps and GameFi ecosystem that found product market fit, particularly with its tap-to-earn products.

So, while the immediate reaction to Pavel’s arrest is “Telegram is done” the charts paint a different picture. TON dipped ~27% on news of the arrest but did not break range and is now at $5.6, a 12% bounce off the lows.

TON has an established user base. We’ve seen networks like SOL shake off concerns about outages. The worst of the Pavel news seems to be over for now. So, while people are quick to dismiss TON, in crypto, what doesn’t kill you makes you stronger. If TON bounces back, it gives confidence to holders that the protocol is here to stay.

Ton

Kerosene

Each cycle has a decentralized stablecoin that takes center stage. In 2018, it was DAI; in 2021, it was Luna. While it’s too early to say if we found this cycles version, DYAD and its token Kerosene (up 4.8x in a month) have caught everyone’s attention. While Vitalik probably hates this project lol, this is the kind of experimentation reminiscent of DeFi Summer in 2020.

What is DYAD?

DYAD is a CDP-based stablecoin project, but unlike Maker, it allows users to mint stablecoins at a 1:1 collateralization ratio. This is made possible by KEROSENE, the utility token that grants users access to excess capital in the system.

Blocmates does a great job breaking this down in more detail:

Why is this significant?

KEROSENE pumping marks a shift in investor preferences. The market ignored this project earlier in the year when it was focused solely on memes. Now that the meme narrative is exhausted, the market is looking for the next thing. KEROSENE, along with AAVE and DeFi coins pumping give us hints about where attention will go next.

🤑 Notable Raises

Nectar AI - $3.9M Seed. Sector: AI. Lead investors are Mechanism & Karatage. Notable investors include Maelstrom & Builder Capital.

OneBalance - $5M Angel. Sector: Infra. Lead investors are Konstantin Lomashuk & Vasiliy Shapovalov.

BTA Protocol - $1.5M Series A. Sector: BTC. Lead investors is Athena Ventures. Notable investors include Seed Club Ventures & Vessel.

Ducat - $1.25M Pre-seed. Sector: BTC DeFi. Lead investor is UTXO. Notable investors include CMS & Revelo Intel.

Fanton - $1M Seed. Sector: GameFi. Lead Investors are Delphi & Animoca, & Kenetic.

👊 Quick Hits

Sony: Launches L2 on Ethereum called “Soneium.”

AAVE: The number one lending protocol expands to zkSync mainnet

Opensea: Receives Wells Notice from the SEC

Maker: Rebrands to “Sky” and annouces a reward program for early users.

Eigenlayer: Expands restakable assets to any ERC-20 token.

Uniswap: Launches .uni.eth usernames - free to claim on their mobile app

Andre Cronje: Explains how DeFi can foster inclusion in ways TradFi has failed.

Arthur Hayes: latest essay “Sugar High” details how poor central bank decisions will lead to a crypto bull run.

🫡 Meme of the week

No one knows pain like ETH investors

These eth podcasts are getting out of hand

— icebergy ❄️ (@icebergy_)

2:00 PM • Aug 27, 2024

See you next week,

Mid-Curve Team

The Mid-Curve newsletter is intended purely for educational and informational purposes and should not be construed as financial advice. We encourage all our readers to conduct their own research or seek advice from a certified financial advisor before making any investment decisions. Please note that members of the Mid-Curve team may hold positions in some of the investments discussed in our newsletter.